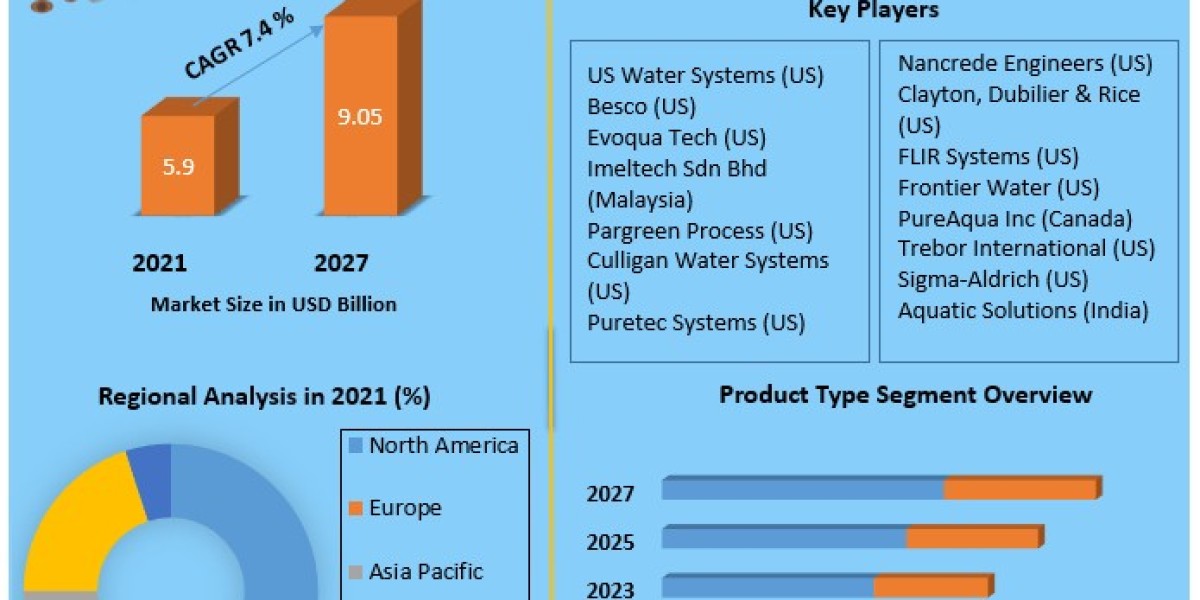

Deionized Water Systems Market to Surpass USD 10.8 Billion by 2028, Driven by Industrial Demand and Water Purity Standards

Market Size

- 2023 Market Value: Approximately USD 7.2 Billion

- 2024 Projection: USD 7.8 Billion

- 2028 Forecast: USD 10.8 Billion

- CAGR: Estimated at 8.4% to 8.6% from 2023 to 2028

Overview

Deionized water systems are used to remove mineral salts and ions from water through ion-exchange, reverse osmosis, or electrodeionization technologies. These systems are vital for applications requiring ultra-pure water, such as in pharmaceuticals, electronics manufacturing, power plants, and laboratories. As global concerns over water contamination rise and industries demand cleaner production environments, the need for high-efficiency deionized water systems continues to grow rapidly.

With advancements in smart technology, real-time monitoring, and automation, modern DI systems are becoming more precise, compact, and environmentally sustainable. The integration of digital tools, modular systems, and hybrid filtration technologies is driving adoption across both developed and emerging markets.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/147259/

Market Growth Drivers & Opportunities

Key Drivers

- High-Purity Industrial Demand

Semiconductor manufacturing, biotechnology, pharmaceuticals, and power generation industries are increasingly reliant on ultrapure water. Deionized systems enable the prevention of scale buildup, corrosion, and contamination in sensitive operations. - Stringent Environmental & Regulatory Standards

Governments and industry bodies are implementing strict standards for water usage and discharge, pushing manufacturers to adopt DI systems that ensure compliance and reduce wastewater. - Water Scarcity and Reuse Initiatives

Rising global water scarcity is compelling industries to adopt water reuse solutions. DI systems, especially when integrated with zero-liquid-discharge (ZLD) technologies, support sustainability goals. - Smart and Modular Technologies

The market is seeing a shift towards intelligent DI systems that feature automated diagnostics, sensor-based monitoring, and mobile app control. Modular designs enhance scalability and flexibility for varied industrial needs.

Emerging Opportunities

- Portable and Mobile DI Units

Growing demand for compact, field-deployable DI systems in temporary labs, research expeditions, and mobile healthcare facilities. - Rising Adoption in New Sectors

Expansion into food & beverage, cosmetics, personal care, and agriculture sectors is creating new avenues for growth. - Untapped Emerging Markets

Latin America, Middle East, and Africa are seeing increasing investments in infrastructure and industrial expansion, offering long-term growth prospects for DI systems.

Segmentation Analysis

By Technology

- Ion-Exchange (Two-Bed & Mixed-Bed)

Traditional systems using resins to remove both cations and anions. - Electrodeionization (EDI)

A continuous, chemical-free system ideal for pharmaceutical and microelectronics applications. - Reverse Osmosis (RO) + DI Hybrids

Combines membrane filtration and ion exchange for higher efficiency. - Distillation-Based Systems

Used in specialized or legacy operations.

By Product Type

- Single-Stage Systems

Suitable for general lab or utility applications. - Multi-Stage Systems

Used in complex processes requiring extremely high-purity water. - Mobile/Portable Units

Ideal for point-of-use water purification in remote or temporary locations. - Resin Cartridges and Modules

Replaceable components used for maintenance and customization.

By Flow Rate

- Low Flow Systems

Typically used in labs and small-scale operations. - Medium Flow Systems

Suited for medium-sized industrial needs. - High Flow Systems

Installed in large-scale manufacturing or utility operations.

By Application

- Pharmaceuticals & Biotechnology

- Semiconductors & Electronics

- Power Generation

- Laboratory and Research Facilities

- Food & Beverage Industry

- Healthcare & Diagnostics

- Environmental Testing

- Cosmetic & Personal Care

By Purity Level

- Low Purity Water (Type III)

- Intermediate Purity Water (Type II)

- Ultrapure Water (Type I)

Major Manufacturers

- Evoqua Water Technologies

- Veolia Water Technologies & Solutions

- US Water Systems

- Culligan

- Pure Aqua

- Merck (Sigma-Aldrich)

- Pargreen

- Suez

- IMELTECH

- Besco

- Newater Technology

- Nancrede Engineering

- Other regional DI system integrators and suppliers

Regional Analysis

United States

A mature and highly regulated market where pharmaceutical, biotech, and semiconductor sectors drive steady demand. Federal investment in manufacturing resilience and the expansion of cleanroom environments contribute to continued growth.

Germany

One of Europe’s most advanced markets, Germany’s focus on industrial automation and clean technologies supports the adoption of intelligent DI water systems. Environmental regulations in the EU also enforce strict water quality controls, further boosting system upgrades.

China

With its position as a global manufacturing powerhouse, China’s rising output in semiconductors, solar panels, and pharmaceuticals requires continuous access to high-purity water. National policies that support green manufacturing are also accelerating DI adoption.

India

A growing economy with increasing investments in infrastructure, healthcare, and research facilities. Demand is rising particularly in the diagnostics, food processing, and electronics sectors.

Middle East & Africa

Industrialization and urban development are prompting demand for water treatment solutions. GCC nations are investing in energy-efficient desalination and purification technologies, including DI systems.

COVID-19 Impact Analysis

The pandemic initially disrupted supply chains and delayed installations of industrial water systems. However, as pharmaceutical production and laboratory testing scaled up in response to COVID-19, demand for ultrapure water solutions surged. Long-term, the crisis accelerated digital transformation and remote diagnostics capabilities within water systems, reinforcing the shift toward automated and sensor-driven DI platforms.

Commutator Analysis

Deionized water systems are built with precision components that determine their performance, longevity, and compliance:

- Ion Exchange Columns

Dual-bed or mixed-bed configurations tailored for varying purification levels. - Electrodeionization Units

Integrate continuous deionization and regeneration without chemical addition. - Smart Sensors and Monitors

Track conductivity, pressure, temperature, and flow to ensure optimal performance. - Control Panels and PLCs

Digital interfaces that offer real-time diagnostics, data logging, and remote access. - Wastewater Recovery Systems

Zero-liquid-discharge (ZLD) setups reduce waste and meet environmental compliance. - Modular Cartridges and Skids

Enable rapid customization and on-site expansion.

These technical elements enhance operational efficiency, reduce costs, and ensure compliance with global water standards.

Key Questions Answered

- What is the current market value and growth forecast?

The market stands at approximately USD 7.2 billion in 2023 and is projected to grow to USD 10.8 billion by 2028, with a CAGR of 8.4–8.6%. - What technologies are dominating the market?

Ion exchange, EDI, and RO+DI hybrid systems are the most widely used technologies across sectors. - Which industries are the primary adopters?

Pharmaceuticals, electronics, power generation, food & beverage, and laboratories are the largest end-users. - Which regions are expected to lead in the coming years?

North America currently leads, while Asia-Pacific—especially China and India—exhibits the fastest growth. Europe follows closely due to stringent regulations. - What role did COVID-19 play in shaping the market?

Initially disruptive, COVID-19 eventually accelerated demand for DI systems in healthcare and testing, and encouraged digital transformation in water treatment.

Conclusion

The global deionized water systems market is evolving rapidly in response to rising industrial purity demands, environmental compliance needs, and technological innovation. With key sectors such as pharmaceuticals, electronics, and power generation relying heavily on ultra-clean water, DI systems are becoming essential infrastructure. Manufacturers are embracing automation, modularity, and sustainability, while emerging markets are stepping up investment in clean technologies. As the world shifts toward efficiency and purity in water usage, deionized water systems are poised to play a central role in driving industrial productivity, health safety, and environmental responsibility.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

? +91 96073 65656

✉️ sales@maximizemarketresearch.com