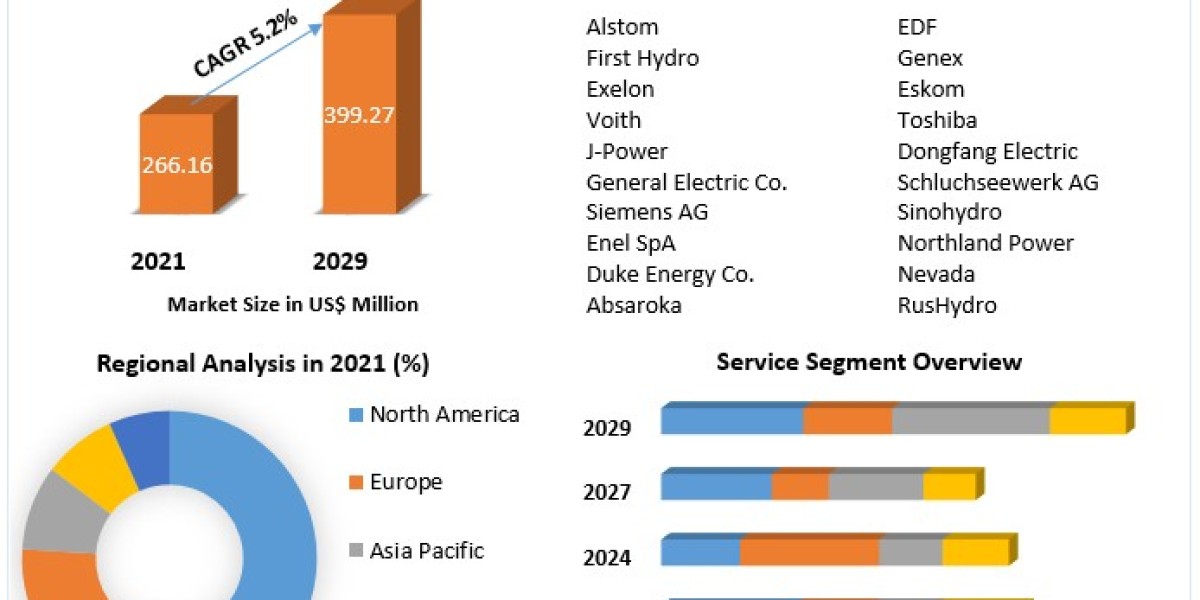

Hydro‑Pumped Storage Plants Market size is expected to reach US$ 399.27 Bn. by 2029, at a CAGR of 5.2% during the forecast period.

1. Market Size

- 2024 Estimated Value: USD 365 billion

- 2030 Forecast Value: USD 500–510 billion

- CAGR (2024–2030): ~5.4–6%

This growth highlights the critical role pumped storage plays in balancing renewables and stabilizing power systems.

2. Overview

Hydro‑pumped storage plants (HPSP) store energy by pumping water uphill during periods of low demand and releasing it through turbines when demand is high. These systems, ranging from open and closed loops to innovative modular designs, offer large-scale, reliable, long-duration storage with lifespans exceeding 40 years.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/70495/

3. Market Estimation & Definition

The HPSP market encompasses:

- System Types: Open-loop, closed-loop, and advanced modular solutions

- Capacity Ranges: Under 500 MW, 500–1000 MW, and over 1000 MW

- End-User Segments: Grid operators, utilities, renewables developers, and industrial consumers

- Geographic Regions: Global—Asia‑Pacific, Europe, North America, Latin America, MEA

4. Market Growth Drivers & Opportunities

- Renewable Integration: Pumped storage supports grid stability amid variable wind and solar supply.

- Rising Installed Base: Global HPSP capacity reached ~181 GW by 2023. China is on track to exceed 130 GW by 2030

- Modernization of Assets: Upgrades like variable-speed turbines increase efficiency.

- Policy Support: New initiatives in regions like the UK and EU offer financial incentives.

- Hybrid Innovation: Integrating with solar, hydrogen, and waste heat broadens utility.

5. Segmentation Analysis

- By Type:

- Open-loop plants capture natural lake or reservoir use.

- Closed-loop systems operate independently of natural water bodies.

- By Capacity:

- Under 500 MW: Smaller and modular installations

- 500–1000 MW: Standard mid-size plants

- 1000 MW: Large-scale “bulk storage” systems

- By Region:

- Asia‑Pacific leads in installed capacity and new projects.

- Europe and North America pursue upgrades and grid stabilization projects.

6. Major Manufacturers & Developers

Key global players include:

- Siemens Energy

- General Electric

- Voith Hydro

- Andritz Hydro

- Alstom

- Enel

- EDF

- Duke Energy

- Mitsubishi Heavy Industries

These firms lead with hydraulic engineering, reversible turbines, and digital system integration.

7. Regional Analysis

- Asia‑Pacific: Market leader—China has around 59 GW in service and 200+ GW under development

- Europe: Maintaining ~59% market share in capacity and modernization driven by renewables .

- North America: Investing in upgrades and new builds amid grid transformation.

- Latin America & MEA: Emerging markets tapping hydropower's storage potential.

8. Country-Level Analysis

- China: Adding nearly 8 GW annually; aiming for ~130 GW this decade

- United States & Canada: Investing in modernization of legacy plants with digital controls.

- European Nations: France, Germany, Spain boosting storage to stabilize renewable uptake.

- India: ~4.8 GW installed; another ~2.8 GW under construction.

- Australia: Projects like Snowy 2.0 (2.2 GW/350 GWh) are under development

9. COVID‑19 Impact Analysis

Construction delays and supply chain disruptions during 2020 slowed new builds. Recovery was swift as stimulus programs prioritized energy infrastructure. Pandemic-induced acceleration in grid modernization increased demand for pump‑storage resilience.

10. Competitor (Commutator) Analysis

- Market Dynamics: Dominated by large engineering & utility companies; niche modular players emerging.

- Strategic Trends:

- Variable-speed turbines and digital control systems

- Closed-loop modular plants with lower construction barriers

- Hybrid solutions coupling renewables and H2 production

- Challenges:

- High upfront costs, environmental permitting, long lead times

- Opportunities:

- Retrofitting existing dams

- Small-scale and modular PS units

- Ancillary services in high-renewable grids

11. Key Questions Answered

Question | Answer |

What’s the market size now? | ~USD 365 B (2024) |

2024–2030 growth projection? | ~USD 500 B by 2030 at ~5–6% CAGR |

What capacity is installed? | ~181 GW globally; China ~59 GW |

Which type grows fastest? | Closed-loop modular plants |

Major players? | Siemens, GE, Voith, Andritz, Alstom |

Which regions lead? | Asia‑Pacific leads; Europe follows |

COVID impact? | Delays, followed by stimulus-driven rebound |

12. Press Release Conclusion

Hydro‑pumped storage stands as the foundation of long-duration, grid-scale energy storage, essential for renewable integration. As global capacity nears USD 500 billion by 2030, innovations in modular design, digital modernization, and hybrid linkages will propel the sector forward. Developers who advance variable-speed, closed-loop systems

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

? +91 96073 65656

✉️ sales@maximizemarketresearch.com