Effective accounts receivable (AR) management is the lifeblood of a healthy business. It's the process of ensuring that your business receives payments for goods or services rendered in a timely manner. While it sounds straightforward, the reality for many businesses is a complex web of unpaid invoices, follow-up calls, and manual tracking that can quickly become overwhelming. Without a robust system in place, a company's cash flow can suffer, leading to liquidity issues that stunt growth and even threaten survival.

Ignoring AR can have a domino effect on your entire financial ecosystem. Delayed payments not only tie up working capital but can also lead to increased administrative costs as staff spend valuable time chasing down payments instead of focusing on core business activities. This is where professional accounts receivable management services become not just a convenience, but a strategic necessity. By outsourcing this critical function, businesses can transform a significant operational challenge into a powerful driver of efficiency and financial stability.

Here are some of the key benefits of using professional accounts receivable management services:

- Improved Cash Flow: Timely invoice collection ensures a steady and predictable inflow of cash, allowing you to meet operational expenses, invest in new projects, and plan for the future with confidence.

- Reduced Days Sales Outstanding (DSO): A lower DSO means you are collecting payments faster. Professional services utilize proven strategies and automated systems to significantly reduce the time it takes to get paid, freeing up capital that would otherwise be tied up in outstanding invoices.

- Lower Administrative Costs: By outsourcing AR to a specialized team, you can reduce the need for in-house staff dedicated to collections, saving on salaries, benefits, and training.

- Decreased Bad Debt: Expert AR teams are skilled at managing collections and can often recover payments that an internal team might have written off as uncollectible, thereby minimizing bad debt write-offs.

- Enhanced Customer Relationships: Professional AR services handle communications with clients in a polite and structured manner, ensuring that payment requests are handled efficiently without damaging valuable customer relationships.

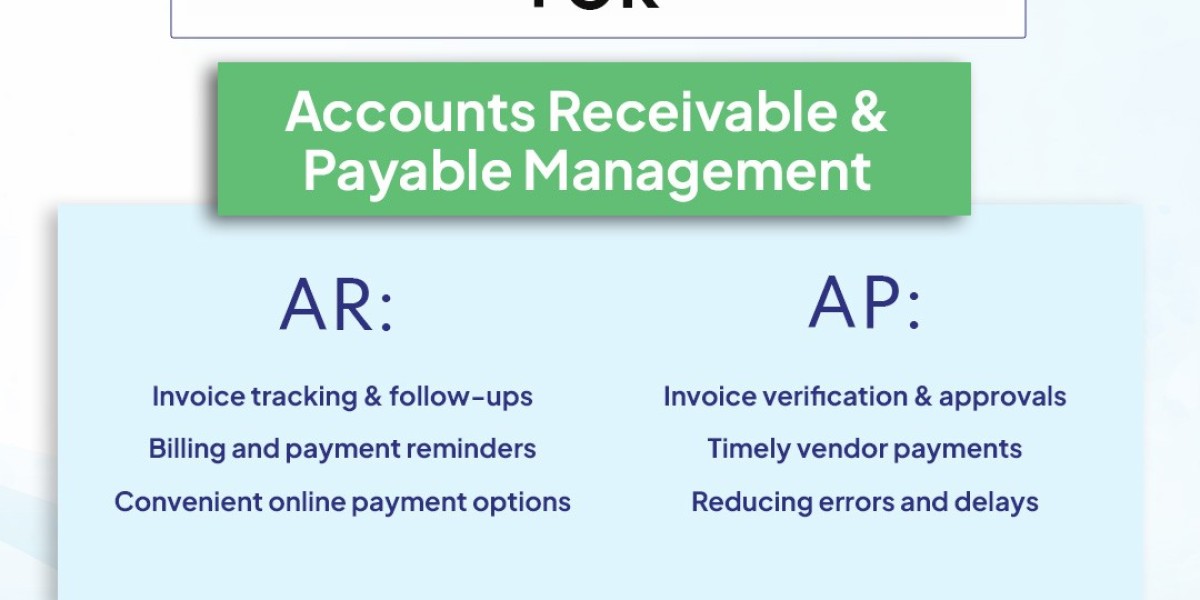

The Components of a Robust AR System

An effective accounts receivable management system is built on a foundation of several key components, from the initial invoicing process to the final payment reconciliation. The goal is to create a seamless and efficient workflow that minimizes errors, reduces delays, and provides clear visibility into the financial health of your business. This journey begins with the precision of your invoicing and extends to the diligent follow-up and reporting that keeps your financial records pristine.

Leveraging modern technology is crucial for optimizing this process. Automation, for example, has revolutionized AR by eliminating repetitive manual tasks. Systems can be configured to automatically send out invoices, issue payment reminders, and even generate reports on outstanding balances. This not only saves time but also drastically reduces the risk of human error, ensuring accuracy and consistency across all transactions. A strategic approach to AR management, combined with the right tools, empowers businesses to maintain financial control and focus on what they do best.

Key aspects of an effective accounts receivable management system include:

- Automated Invoicing and Reminders: Systems that automatically generate and send invoices and follow-up reminders based on pre-set schedules help to ensure a consistent and timely collection process.

- Customer Credit Management: A professional service can assess the creditworthiness of your clients, helping you to set appropriate credit limits and minimize the risk of non-payment.

- Payment Gateway Integration: Integrating with multiple payment gateways makes it easier for your customers to pay you, which can accelerate the payment cycle.

- Detailed Reporting and Analytics: A robust system provides real-time insights into your AR metrics, allowing you to track performance, identify potential issues, and make informed financial decisions.

About IBN Technologies

IBN Technologies is a premier outsourcing partner with over two decades of experience, offering comprehensive solutions across finance, accounting, IT, and back-office operations. They specialize in a wide range of services, including bookkeeping, tax preparation, and of course, expert accounts receivable management. By combining deep industry knowledge with a commitment to process efficiency and technological innovation, IBN Technologies helps businesses streamline their financial operations, improve cash flow, and achieve sustainable growth. Their team of skilled professionals works as a strategic extension of your business, providing tailored solutions designed to meet your specific financial needs and challenges.

Conclusion

In today's fast-paced business world, a proactive and efficient approach to accounts receivable management is no longer optional. It is a fundamental requirement for maintaining a healthy financial standing and enabling long-term growth. By partnering with a dedicated service provider like IBN Technologies, you can offload the complexities of AR and gain the peace of mind that comes from knowing your cash flow is in expert hands. This strategic decision allows you to shift your focus from chasing payments to developing your business, innovating new services, and expanding into new markets. Take control of your financial future and transform your AR process from a burden into a powerful asset.