Market Estimation & Definition

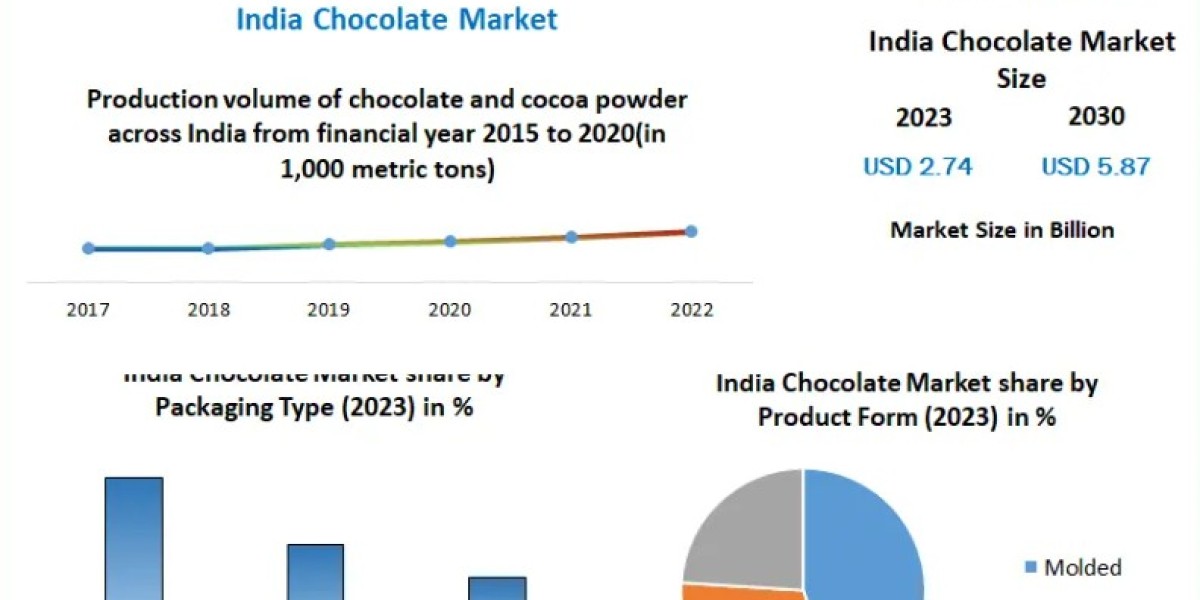

The India Chocolate Market was valued at USD 2.74 billion in 2023 and is projected to reach USD 5.87 billion by 2030, growing at a robust CAGR of 11.5% during 2024–2030. Chocolate, derived from cacao seed kernels, is available in liquid, solid, or paste forms and consumed both as confectionery and as a key flavoring ingredient in bakery and dessert products.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/24126/

Market Growth Drivers & Opportunity

Several factors are fueling this strong growth trajectory. Rising disposable incomes and an expanding middle-class population are significantly increasing chocolate consumption. India’s rich tradition of gifting during festivals and special occasions further boosts demand, while urban lifestyles and growing health awareness are spurring interest in premium dark chocolates and reduced-sugar variants.

The rapid expansion of modern retail and e-commerce platforms is widening product accessibility, particularly in urban centers. Rural penetration, still in its early stages, presents a vast untapped opportunity. Additionally, innovations in flavors, vegan and organic variants, and eco-friendly packaging are creating new avenues for brand differentiation and consumer loyalty.

What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, premiumization will remain a defining trend, with consumers opting for high-quality, smaller-bite chocolates and dark varieties. Localized flavor innovation—such as spices, herbs, and fruit-infused chocolates—is gaining traction among younger demographics. Health-driven and functional chocolates, including sugar-free, organic, and vegan options, are expected to expand their market share. Sustainability initiatives, including biodegradable packaging and ethically sourced cacao, are also becoming a critical purchase driver. Furthermore, advanced packaging and preservation technologies will enhance product shelf life and maintain quality, helping brands tap into broader distribution channels.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/24126/

Segmentation Analysis

By Product Type: Milk Chocolate, White Chocolate, Dark Chocolate, Others. Milk chocolate remains the dominant category, while dark chocolate is witnessing rapid adoption.

By Product Form: Molded, Countline, Others. Molded chocolates continue to lead, supported by their popularity as gifts and their strong shelf appeal.

By Packaging Type: Pouches & Bags, Boxed Chocolate, Others. Boxed chocolates are closely linked with the festival and gifting culture, while flexible packaging appeals to everyday consumers.

Country-level Comparison: USA & Germany

In contrast to mature markets such as the USA and Germany, where per-capita chocolate consumption is among the highest globally and premium artisan segments are well established, India stands out for its growth potential. With a youthful demographic, rising urbanization, and a cultural emphasis on gifting, India provides multinational and domestic companies with both volume and value-driven opportunities. While the USA and Germany focus on premium and specialty categories, India’s market is evolving toward this direction while maintaining affordability as a core growth lever.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/24126/

Competitor Analysis

The competitive landscape is led by multinational giants such as Mondelez, Ferrero, Nestlé, and Mars, alongside strong domestic players like ITC, Amul, and Hershey India. Mondelez continues to dominate with its extensive product portfolio and wide distribution network. However, local brands are leveraging affordability, health-centric positioning, and festive packaging to capture market share. The competition is intensifying around product innovation, seasonal launches, and deeper penetration into Tier-II and Tier-III cities.

Conclusion

India’s chocolate market is entering an exciting growth phase, driven by rising incomes, lifestyle changes, and evolving consumer preferences. With a projected double-digit CAGR, the sector is primed for expansion and transformation. Companies that focus on premiumization, health-based innovations, sustainable practices, and strong distribution networks will be best positioned to lead this dynamic market into the next decade.

About Us