In today’s competitive IT industry, organizations face constant pressure to innovate, scale, and stay compliant while maintaining cost efficiency. Managing a diverse and skilled workforce—comprising developers, project managers, designers, and consultants—demands streamlined HR and financial operations. Among these, payroll management stands as one of the most critical yet complex functions.

Partnering with expert payroll service companies allows IT organizations to simplify administrative burdens, enhance accuracy, and maintain compliance, while ensuring employees are paid on time—every time. By integrating advanced online payroll services and adopting intelligent payroll management solutions, IT companies can focus on growth and innovation rather than administrative challenges.

The Importance of Payroll Services in the IT Industry

Payroll is more than just paying employees—it’s about compliance, transparency, and efficiency. For IT companies managing hundreds of employees across geographies, payroll processing involves multiple layers, including taxation, deductions, reimbursements, and performance-based incentives.

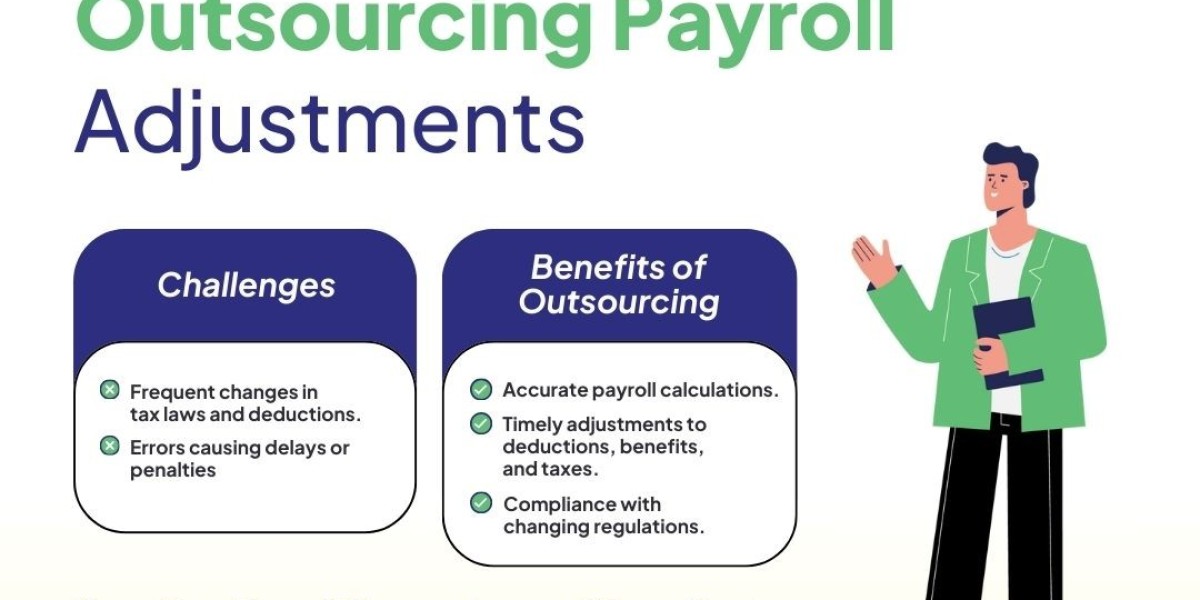

Manual payroll management can lead to delays, calculation errors, and compliance issues, affecting employee satisfaction and productivity. To overcome these challenges, payroll service companies offer comprehensive and automated payroll solutions tailored to the specific needs of IT businesses.

These solutions not only handle salary disbursement but also integrate with HR and accounting systems, ensuring smooth end-to-end workforce management.

Why IT Companies Should Outsource Payroll Services

1. Focus on Core Operations

In the fast-paced IT industry, every hour counts. By outsourcing to professional payroll service companies, organizations can redirect internal resources toward innovation, client projects, and product development instead of managing repetitive payroll tasks.

2. Enhanced Accuracy and Compliance

Payroll errors can lead to financial losses, compliance penalties, and employee dissatisfaction. Certified online payroll services use advanced automation and AI-based algorithms to ensure error-free calculations, accurate tax withholdings, and timely statutory filings.

Moreover, IT firms often operate across multiple states or countries, each with distinct labor laws and tax regulations. Outsourced payroll providers stay updated on compliance changes, ensuring businesses always meet legal requirements.

3. Data Security and Confidentiality

Given the sensitivity of payroll data—salaries, bank details, and tax information—security is paramount. Professional payroll management platforms employ advanced encryption and multi-factor authentication to safeguard employee information.

Cloud-based payroll systems ensure secure access control and compliance with global data protection standards, such as GDPR and ISO 27001, which are essential for IT firms handling confidential client data.

4. Cost Savings

Establishing an in-house payroll department can be expensive. Outsourcing eliminates the need for additional staff, software maintenance, and training costs. With online payroll services, IT companies pay only for what they use—achieving predictable, cost-effective operations without compromising on quality or compliance.

Features of Advanced Payroll Management Solutions

Modern payroll management systems designed for the IT sector offer a range of automation and integration features, including:

Automated salary calculations based on attendance, performance, and benefits.

Tax and compliance automation covering income tax, provident fund, and statutory deductions.

Employee self-service portals for viewing payslips, tax forms, and leave balances.

Integration with HR and accounting tools like SAP, QuickBooks, or Workday.

Cloud accessibility enabling remote payroll operations for distributed teams.

Such comprehensive systems help IT companies maintain accuracy, transparency, and scalability as they expand operations globally.

Benefits of Online Payroll Services for IT Businesses

1. Real-Time Access and Reporting

IT leaders can access payroll data anytime through cloud-based dashboards. This provides insights into salary structures, overtime, tax liabilities, and workforce costs, enabling data-driven financial decisions.

2. Employee Satisfaction and Retention

A timely, transparent, and error-free payroll system fosters employee trust. When employees have access to self-service tools for payslips, reimbursements, and tax forms, their engagement and satisfaction increase—helping IT firms retain top talent in a highly competitive market.

3. Seamless Multi-Country Payroll Management

Global IT companies often have employees, contractors, and consultants across different countries. Online payroll services simplify cross-border payments by managing multi-currency payroll, tax compliance, and local statutory requirements—all within a single platform.

4. Business Continuity and Scalability

Cloud-based payroll solutions ensure uninterrupted payroll processing even in times of disruption, such as remote work transitions or global crises. Scalable systems allow IT firms to easily add or remove employees, departments, or locations as business demands evolve.

How Payroll Service Companies Empower IT Operations

Leading payroll service companies not only manage routine payroll but also provide value-added services, such as:

Payroll analytics for financial forecasting and cost optimization.

Compliance consulting to ensure adherence to international labor laws.

Integration support for connecting payroll data with HR and ERP systems.

Custom workflows designed for project-based or contract-based IT environments.

This level of expertise allows IT companies to maintain transparency, reduce operational risks, and enhance productivity.

The Role of Technology in Payroll Transformation

As the IT industry drives digital transformation for clients, it is equally embracing innovation internally. Modern payroll platforms use artificial intelligence (AI), machine learning (ML), and data analytics to improve accuracy and predict payroll trends.

For instance:

AI detects anomalies or potential payroll fraud.

ML algorithms forecast payroll expenses for upcoming projects.

Automation tools handle bulk employee onboarding and offboarding.

Mobile apps are also becoming common, enabling employees and managers to review and approve payroll data from anywhere—perfect for IT companies operating in hybrid or global environments.

Compliance and Risk Management in IT Payroll

Payroll compliance is complex due to frequent regulatory updates and multi-jurisdictional requirements. Non-compliance can lead to financial penalties and reputational damage.

By outsourcing payroll, IT companies gain access to dedicated compliance specialists who manage:

Statutory filings (PF, ESIC, TDS, etc.)

Tax compliance and audit-ready reports

Contractor and freelancer payment compliance

Recordkeeping for data audits

This proactive approach helps IT businesses mitigate risks while maintaining transparent employee and financial records.

Conclusion

For IT organizations seeking efficiency, scalability, and compliance, partnering with professional payroll service companies is no longer optional—it’s a strategic necessity. Modern online payroll services and intelligent payroll management platforms streamline complex payroll processes, safeguard sensitive data, and empower companies to focus on their core objective: technological innovation.

By automating payroll operations, ensuring accuracy, and maintaining compliance, IT businesses can boost employee satisfaction and operational performance—building a stronger foundation for long-term success.