As another financial year comes to a close, healthcare organizations across the U.S. are preparing for audits, tax filings, and year-end reconciliations. Managing financial data in such a heavily regulated industry can be overwhelming, especially for facilities that handle multiple revenue sources like patient payments, insurance reimbursements, and vendor transactions. Partnering with Offshore Bookkeeping Services has become a key strategy for healthcare providers seeking accuracy, efficiency, and compliance during the year-end close. These services combine global financial expertise with advanced digital tools to streamline processes and minimize errors.

Overcoming Year-End Challenges in Healthcare Finance

The healthcare sector’s financial ecosystem is intricate. From managing patient billing to reconciling insurance claims, providers face significant accounting challenges throughout the year. When it comes to year-end reporting, inaccuracies or delays can disrupt audits and lead to regulatory complications. Offshore bookkeeping professionals help mitigate these challenges by maintaining precise ledgers, reconciling complex accounts, and preparing financial statements that meet U.S. accounting standards. Their healthcare-specific knowledge ensures that all entries align with industry regulations and audit expectations.

Accuracy and Efficiency in Year-End Reporting

Timely and accurate year-end reporting is critical for healthcare institutions. Offshore teams ensure all financial data is verified, reconciled, and categorized correctly before submission. They use automation tools to process large data volumes quickly, ensuring complete accuracy in balance sheets, profit and loss statements, and tax summaries. This not only enhances the quality of financial reporting but also reduces the time required to finalize accounts. Offshore professionals bring a structured workflow that helps U.S. healthcare firms close their books efficiently without missing deadlines.

Cost-Effective Expertise for Healthcare Organizations

Hiring and retaining in-house accountants can be expensive for small and mid-sized healthcare providers. Offshore bookkeeping offers a cost-effective alternative without compromising quality. These teams deliver expert-level accounting support at a fraction of the cost of domestic hiring. By outsourcing, healthcare organizations gain access to experienced accountants who specialize in healthcare bookkeeping, tax preparation, and financial management. This allows providers to focus on patient care while offshore experts handle complex financial tasks.

Integrating Compliance and Data Security

Healthcare bookkeeping requires adherence to both financial and patient data regulations. Offshore teams providing Outsourced Accounting and Bookkeeping Services are well-versed in U.S. standards, HIPAA compliance, and IRS guidelines. They implement stringent data protection protocols to ensure that sensitive patient and financial data remain secure. During year-end closing, every financial entry is audited for accuracy and compliance, ensuring that all reports are ready for regulators and auditors. This compliance-driven approach minimizes risk and strengthens organizational credibility.

Technology-Driven Year-End Solutions

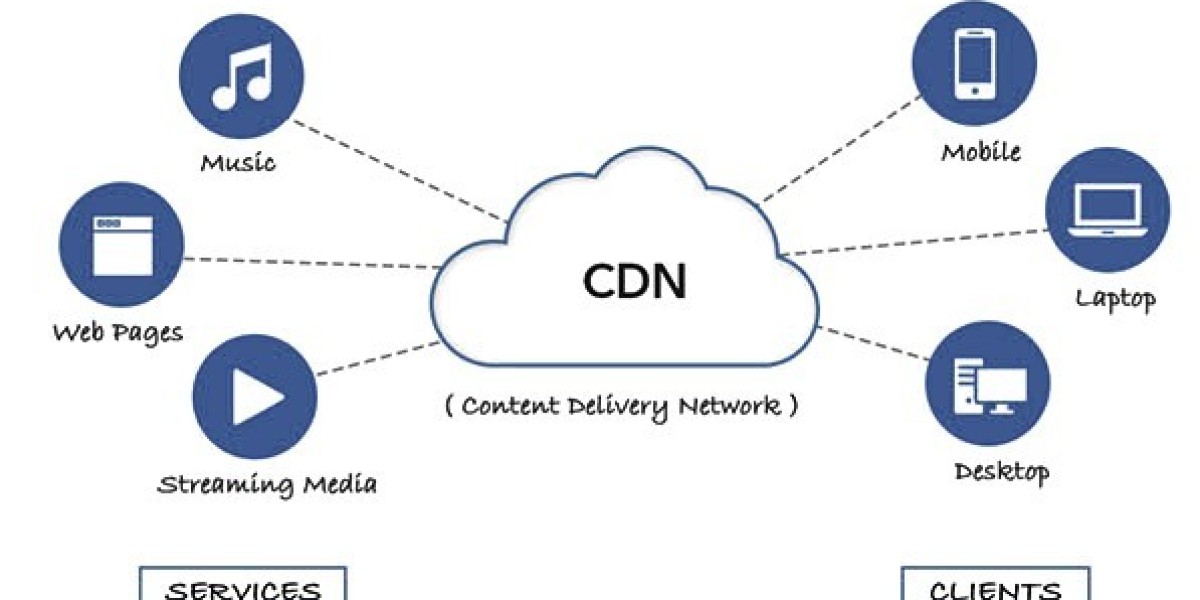

Offshore bookkeeping professionals leverage advanced cloud accounting platforms that integrate seamlessly with healthcare management systems. This ensures that financial data is always up-to-date, accessible, and secure. Through real-time dashboards, healthcare administrators can monitor revenue cycles, track outstanding claims, and view updated cash flow summaries. The use of automation and AI tools minimizes manual effort, enhances accuracy, and provides actionable financial insights essential for year-end decision-making.

Enhancing Scalability and Operational Flexibility

Year-end often brings an increased workload due to reconciliations, audits, and reporting requirements. Offshore bookkeeping teams provide scalability, allowing healthcare organizations to quickly adjust resources according to demand. Whether it’s managing multiple clinic accounts or consolidating financials for a healthcare group, offshore teams offer flexibility to handle high volumes efficiently. This scalability ensures that year-end deadlines are met smoothly while maintaining complete accuracy in reporting.

Strategic Financial Insights for the New Year

Beyond compliance and reporting, offshore professionals deliver valuable financial insights that support strategic planning for the upcoming fiscal year. They analyze year-end data to identify cost inefficiencies, forecast cash flows, and evaluate profitability. These insights help healthcare leaders make informed decisions regarding budget allocations, resource optimization, and growth investments. By leveraging data-driven reports, organizations can enter the new year with a clear roadmap for financial improvement.

Benefits for Small and Mid-Sized Healthcare Providers

Smaller healthcare facilities often lack the internal infrastructure to manage complex accounting operations. Engaging offshore specialists provides them access to high-quality financial management similar to large hospitals. Using Small Business Bookkeeping principles, offshore teams tailor their services to meet the specific needs of small practices—offering efficient invoice management, bank reconciliations, and expense tracking. This ensures that every healthcare provider, regardless of size, can achieve professional financial management during the year-end close.

Improving Collaboration and Transparency

Offshore teams operate as an extension of internal finance departments, ensuring seamless collaboration across time zones. Regular communication, transparent reporting, and secure document sharing make the process efficient and reliable. Healthcare managers have continuous visibility into the progress of year-end reconciliation, enabling faster decision-making and reduced delays. This transparency builds trust and ensures that both parties remain aligned toward common financial goals.

Why Offshore Bookkeeping is the Future of Healthcare Accounting

As the healthcare industry continues to evolve with new technologies and financial complexities, offshore bookkeeping is emerging as a sustainable and strategic solution. It combines skilled manpower, cost efficiency, and automation to deliver reliable financial management. The flexibility and scalability of offshore models make them ideal for organizations looking to streamline year-end processes while maintaining accuracy and compliance.

Related Services :

https://www.ibntech.com/payroll-processing/

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/

About IBN Technologies

IBN Technologies LLC is a global outsourcing and technology partner with over 26 years of experience, serving clients across the United States, United Kingdom, Middle East, and India. With a strong focus on Cybersecurity and Cloud Services, IBN Tech empowers organizations to secure, scale, and modernize their digital infrastructure. Its cybersecurity portfolio includes VAPT, SOC & SIEM, MDR, vCISO, and Microsoft Security solutions, designed to proactively defend against evolving threats and ensure compliance with global standards. In the cloud domain, IBN Tech offers multi-cloud consulting and migration, managed cloud and security services, business continuity and disaster recovery, and DevSecOps implementation—enabling seamless digital transformation and operational resilience.

Complementing its tech-driven offerings, IBN Tech also delivers Finance & Accounting services such as bookkeeping, tax return preparation, payroll, and AP/AR management. These are enhanced with intelligent automation solutions like AP/AR automation, RPA, and workflow automation to drive accuracy and efficiency. Its BPO Services support industries like construction, real estate, and retail with specialized offerings including construction documentation, middle and back-office support, and data entry services.

Certified with ISO 9001:2015 | 20000-1:2018 | 27001:2022, IBN Technologies is a trusted partner for businesses seeking secure, scalable, and future-ready solutions.