The global catalyst carrier market, valued at USD 413 million in 2023, is set to witness remarkable growth, projected to reach USD 770.1 million by 2032 at a robust CAGR of 7.2% during 2024–2032. This upward trajectory is fueled by surging petrochemical production, the shift toward bio-based and recyclable materials, and stringent environmental regulations reshaping industrial operations.

Catalyst carriers, vital in refining and chemical processes, enhance catalyst performance, efficiency, and lifespan. Their applications span oil & gas refining, petrochemicals, chemical manufacturing, and automotive sectors—forming the backbone of industries producing plastics, resins, and synthetic fibers.

Get Ahead of Market Shifts: Request Your Sample Report! https://www.snsinsider.com/sample-request/4680

Petrochemical Boom Fuels Demand

The petrochemical industry’s rapid expansion is a primary driver for the catalyst carrier market. According to the U.S. Energy Information Administration (EIA), U.S. ethylene production capacity—the cornerstone of plastics and other industrial materials—grew nearly 7% between 2020 and 2023.

With global demand for consumer goods and packaging materials rising, petrochemical output is set to surge, further boosting the need for advanced catalyst carriers to optimize refining and production processes.

“Catalyst carriers are no longer just a component—they’re a performance multiplier. As production scales up, the demand for efficient, sustainable, and high-performing carriers will define the competitive edge,” said an industry analyst.

Shift Towards Sustainable Solutions

A significant market trend is the transition to lightweight, bio-based, and recyclable catalyst carriers. Industries are moving away from traditional, fossil-fuel-derived materials toward solutions that align with circular economy principles.

Materials such as biopolymers, silica, and advanced ceramics are gaining traction for their reduced environmental footprint, recyclability, and regulatory compliance benefits.

According to the U.S. Department of Agriculture (USDA), the bio-based products sector contributes USD 369 billion to the U.S. economy and supports over 4 million jobs. Programs like the USDA’s BioPreferred initiative are accelerating adoption, making green catalyst carriers a lucrative growth avenue.

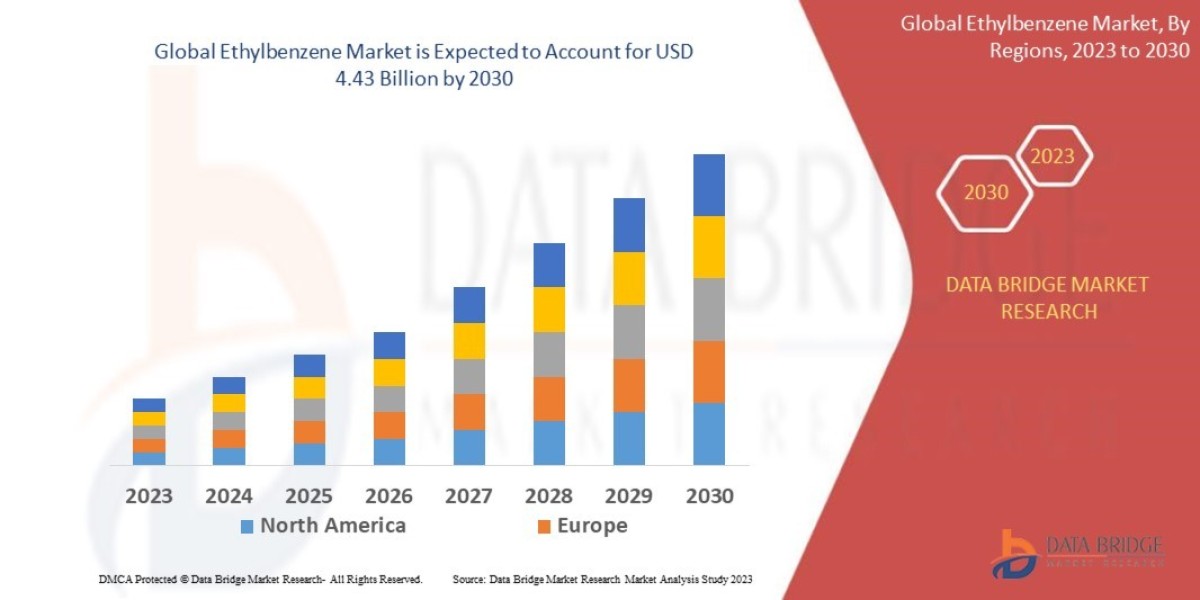

Regional Insights: North America Leads

North America dominated the market in 2023, holding a 43% share. The region benefits from:

- A robust petrochemical and refining base, particularly in the U.S.

- Strong R&D investments aimed at productivity and sustainability.

- Stringent environmental regulations driving innovation in green catalyst technologies.

- A competitive ecosystem with global leaders like BASF SE, Clariant AG, and Evonik Industries AG.

Government-backed clean energy initiatives, such as those promoted by the American Chemistry Council, further strengthen the region’s market position.

Key Market Drivers

- Rising Petrochemical Demand – Expanding plastic, resin, and synthetic fiber production is increasing the need for high-performance catalysts.

- Green Manufacturing Push – Bio-based and recyclable carriers help industries meet sustainability targets and regulatory mandates.

- Advancements in Material Science – New carrier compositions are enhancing catalytic efficiency, reducing energy consumption, and minimizing waste.

Market Challenges

While opportunities are vast, the sector faces hurdles:

- High Initial Costs – Advanced carriers require significant upfront investment.

- Raw Material Price Volatility – Fluctuating costs of metals and specialty ceramics impact margins.

- Complex Regulatory Landscapes – Meeting diverse environmental and safety standards across regions adds to operational complexity.

Opportunities on the Horizon

- Expansion in Asia-Pacific – Rapid industrialization in China, India, and Southeast Asia is driving demand for refining and chemical manufacturing catalysts.

- Technological Breakthroughs – Nanostructured catalyst carriers promise unprecedented efficiency gains.

- Carbon Reduction Targets – Industries pursuing net-zero emissions will increasingly adopt eco-friendly catalyst carriers.

Contact Our Analyst to Assist with Your Questions! https://www.snsinsider.com/request-analyst/4680

Market Segmentation

By Type

- Carbon-Based

- Oxides

- Zirconia

- Others

By End-Use Industry

- Oil & Gas

- Chemical Manufacturing

- Petrochemicals

- Automotive

- Others

Global Coverage

- North America – U.S., Canada, Mexico

- Europe – Eastern & Western Europe

- Asia Pacific – China, India, Japan, South Korea, Australia, and others

- Middle East & Africa – UAE, Saudi Arabia, South Africa, and more

- Latin America – Brazil, Argentina, Colombia

Competitive Landscape

The catalyst carrier market is highly competitive with global players innovating in both material science and production efficiency. Key companies include:

- BASF SE

- Evonik Industries AG

- Saint-Gobain NorPro

- Cabot Corporation

- Clariant AG

- CeramTec GmbH

- W. R. Grace & Co.

- Sasol Limited

- SABIC

- Honeywell UOP, among others.

These companies are leveraging strategic partnerships, acquisitions, and R&D investments to gain market share, with a focus on eco-friendly and high-performance carrier solutions.

Future Outlook

With the petrochemical sector on a growth trajectory and global industries under mounting pressure to cut emissions and adopt circular economy practices, catalyst carriers are becoming more than just an operational necessity—they’re emerging as a strategic asset for industrial competitiveness.

Technological advancements, coupled with a push toward bio-based and recyclable materials, will redefine market dynamics over the next decade.

As regulations tighten and sustainability becomes a competitive differentiator, the catalyst carrier market’s growth prospects remain strong, especially for companies willing to innovate in material science, embrace green manufacturing, and expand into high-growth emerging markets.